Monthly Archives: November 2016

Revisiting Competitive Positioning

Taken from McKinsey, Valuation

- Consider competitive retaliation in response to new tactics

- Creating new services / products have the highest value creating potential (versus taking share from others)

- Higher value add is persuading consumers to buy more of a product / service

- High growth is difficult to sustain

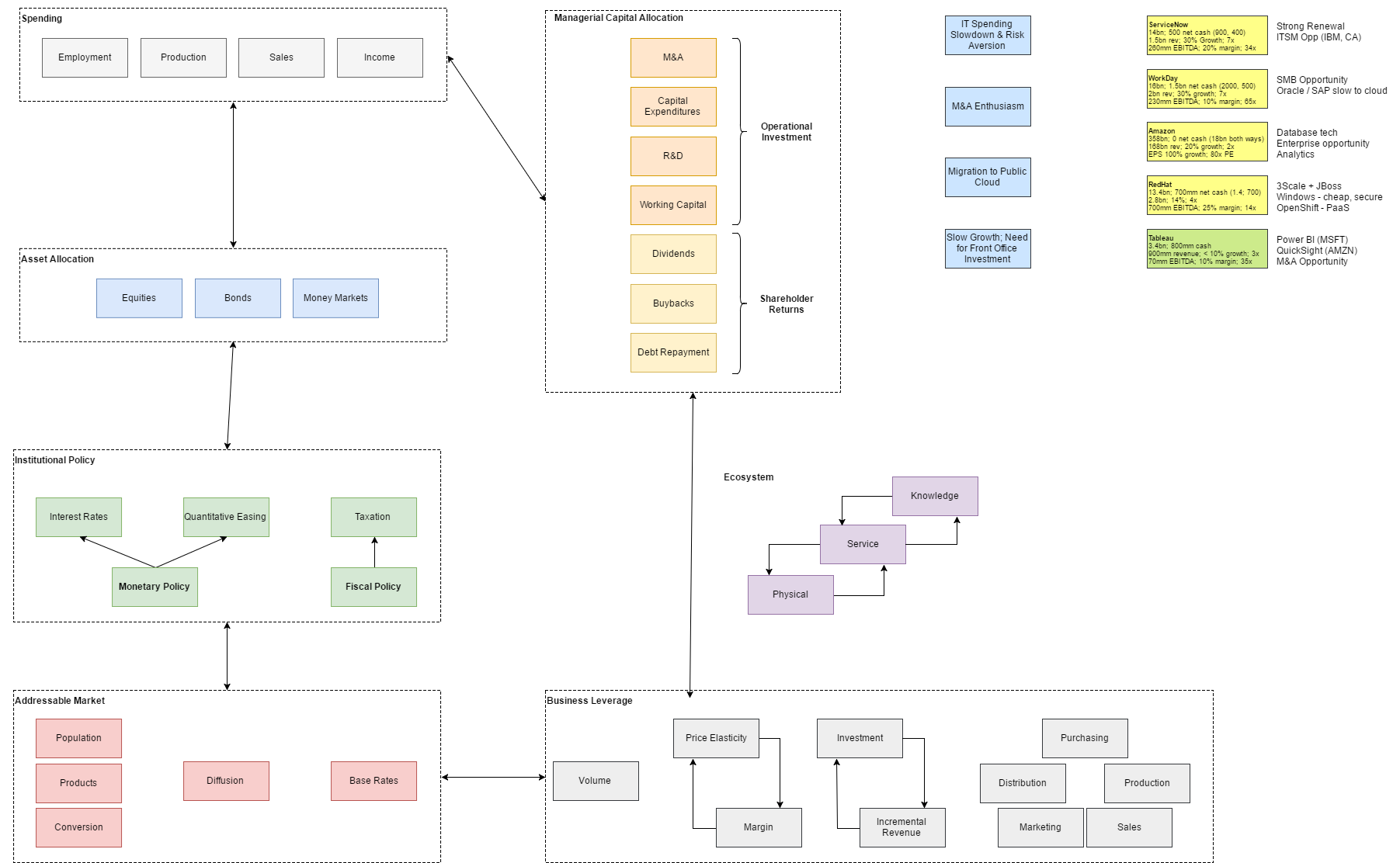

Revisiting Value Frameworks

Several Key Focus Areas, pulling from Margin of Safety and Common Stocks, Uncommon Profits and the Most Important Thing

- Typically would ask: What’s wrong with it? (if presented an undervalaued asset)

- Need to assess the market’s apetite for risk, and stance towards risk aversion (with respect to the capital market line)

- Observe core / systemic business weakness versus market over-reactions: why are companies undervalued? When will they rebound?

- Constantly evaluate: what is the business worth?

- Recall that markets are infefficient (institutional constraints)

- Understand credit cycles

- New product initiatives are a good time to continue increasing observations of a company

- Evaluate management incentives

- Evaluate market and relevancy of products vis a vis market

- How sensitive are customers to pricing?

- What will competitors do in reaction to different courses of action?

- What is the volume outlook for a business?

- Analytical observe market sentiment for industry and individual company

- Observe: capitalization, financial position, breakdown of sales, competitors, insider ownership, margins

Unboxing Core Themes

General Themes

- White box hardware

Red Hat

- Acquisition of 3scale for APIs

- RHEL is currently the cash cow

- JBoss Middleware enables applications to speak together

- OpenShift PaaS / rapid application development through microservices (PaaS)

- OpenStack:

Amazon

- Mix shift to higher profitability cloud, which is expected to be the highest portion of revenue

- Moving upstream from SMB to enterprise

- At recent event, had GM, Coca Cola speak, speaking to effectiveness of enterprise strategy

- Most developers prefer AWS

- Aurora is gaining traction (SQL database)

- RedShift has solid traction (data warehouse)

- Workspaces competes with VMWare and Citrix

- Solid security in public cloud

- Roll-out of QuickSight

- Chosen by GuideWire for IaaS

- Chosen by Salesforce as preferred IaaS hosting

Best-In-Class Offerings

- ServiceNow: opportunity to also penetrate ITSM market; very strong customer renewal rates

- ServiceNow: current beachead in service management (incident, problem, service catalog); moving to operations management (servers, application, storage, virtualization, cloud, network) – this model enables ServiceNow to penetrate a business model typically dominated by incumbents (IBM, CA, Microsoft, BMC)

- Workday: opportunity to move down-stream to penetrate SMB market; incumbents (Oracle, SAP) slower to move to cloud)

- Other higher growth opportunities include marketing / customer service targeting SMB space: Hubspot (inbound marketing); Zendesk (leader in customer services software)

- Slow GDP growth resulting in investments in front office

- Accounting / Enterprise / ERP

- Productivity Applications

- Sales and Marketing Applications

Market has had a defensive posture this year, positively benefiting infrastructure players

- Red Hat

- Oracle

- VMWare

Value Play: BI / Analytics Uncertainty

- Larger players increasing competition for the likes of Tableau with fears of Microsoft, Qlik, and Amazon (QuickSight) getting in the way

Red Hat Overview

Industry

- Faster innovation cycles

- Increased security

Positives

- Unique open source business model

- Low cost technology

- Anchor: Red Hat Enterprise Linux

- Growth lever is OpenStack adoption + storage / middleware (JBoss) + PaaS (OpenShift)

- Positioned to be leader of OpenStack movement

- Positioned to deliver OpenStack across AWS and Azure

- Increasing deal sizes

- High renewal and fast growing renewal rates

Risks

- Susceptible to decreased IT spend (in poor economic environment)

- Ability to de-throne Microsoft

- Growth is driven by non-RHEL products

- Move to public cloud could make AWS linux more appealing

- Most customers are from indirect sales channels

- New products being adopted slower than expected

Updates

- Increased headcount this year