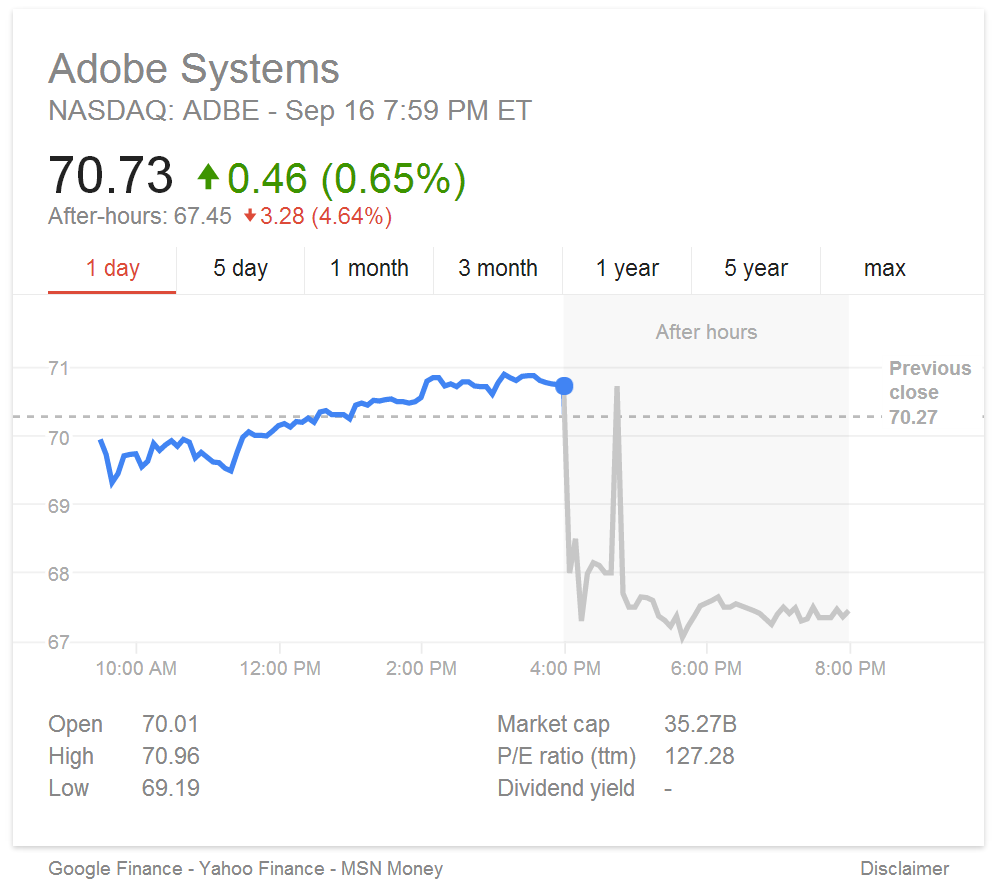

Adobe fell 4.7% in after hours trading following its Q3 earnings call. The Company was punished primarily for missing growth estimates related to sales & customer acquisition ($1.01b revenue; $0.28 eps; 502k new subscribers vs. consensus estimates of $1.02b revenue; $0.26 non-gaap eps; 503k new customers).

Closing just shy of its 50 day moving average ($71.26, $70.73, respectively), Adobe inched closer to its 200 day moving average ($65.56), in after hours trading, closing at $67.45 at 8PM EST.

Making the transition from single purchase sales structures to recurring revenue subscription models has proven difficult for many technology companies. Investors are unsure how to react to tech sector fundamentals, and these companies suffer when classic fundamentals, such as revenue growth, are reported below expectations.

Adobe is in the midst of its migration to a cloud based subscription business, and I recognize these hiccups in valuation as a prime opportunity to take a position with Adobe, and feel bullish on the stock in the long term.

- Customer acquisition growth has declined, but mostly because “loyal” subscribers have already made the leap from the one-time purchase model to the cloud subscription model. Adobe ventures in to new territory by tackling the SMB and other consumers and represents a high growth opportunity

- Meanwhile, revenue will not increase as quickly as anticipated while Adobe takes on the challenge of acquiring new subscribers; however, new subscribers represent a stronger recurring revenue base in the longer term

- Adobe represents the standard in creative computing. Competitors have tried, and failed to compete with its Creative Suite. The cloud will increase the ease of accessing Adobe’s products and will likely create an incentive for individual consumers to purchase, rather than pirate, Adobe products

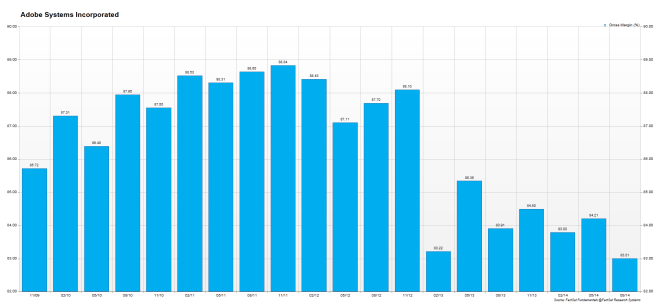

- Lastly, Adobe’s gross margins represent significant room for improvement on a relative basis. As the Company continues to convert customers to its subscription model, margin improvements will be a key metric of analysis during future earnings calls