A friend recently brought up an interesting equity play, noting that he is looking to put a signficant position on a chicken producer called Sanderson Farms. His assertions included the idea that export bans to China and Russia cannot extend indefinitely and that the Company represents a good acquisition opportunity for a larger competitor, Pilgrim’s Pride (PPC). I decided to dive a little deeper.

Overview

SAFM has historically traded at a discount to its peers due to its high leverage structure, but in recent times has been able to demonstrate its ability to generate strong cash flows in the absence of leverage. As a result, the market has rewarded SAFM by closing its performance gap relative to its peers.

Currently, Sanderson Farms is trading at a discount to its historical EV / NTM EBITDA multiple. It’s primary competitors, Tyson Foods and Pilgrim’s Pride trade at significantly higher multiples. This is largely due in part to each of its competitors ability to diversify its revenue streams and shield itself from volatile commodity prices which are necessary inputs in the process of feeding chicken + pork.

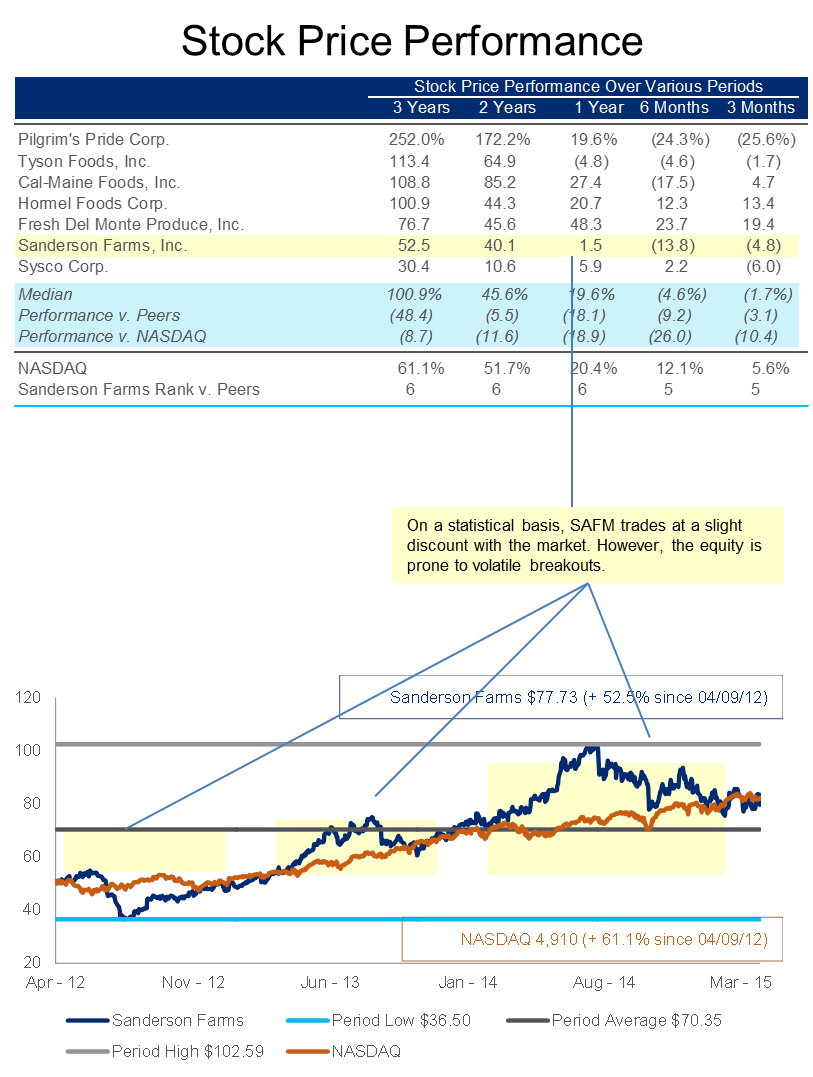

As we can see from the graph above, SAFM trades largely in line with the NASDAQ. However, the equity is particularly prone to large, volatile swings. The reason for this is because SAFM’s margins are prone to price swings in Corn and Soybeans which are used to feed chickens. Unlike Tyson and Pilgrim’s Pride (who have more diversified food lines), SAFM is particularly vulnerable to these two inputs.

SAFM has exhibited volatile price performance at a rate highly correlated with that of movements in corn and soybean prices.

As a result, Wall Street Consensus has voted that the Company’s cash flows will be largely affected in CY16. I foresee Corn and Soybean prices being a large factor affecting SAFM’s future performance which is reflected in SAFM’s current prices.

It will be important to track the following in the coming days:

- The spread of the Avian bird flu. This epidemic is reflected in SAFM’s depressed prices. While SAFM has generally always traded at a discount relative to its peer median group, it has demonstrated a propensity to trade more in line with their valuations. I believe this is due to their low-risk capitalization profile. YTD, SAFM has traded at closer to 80% of its peers group valuation (>4.0x EV/ EBITDA). The current drop-off represents an attractive entry point for SAFM. If the Company can avoid infection, it will reap the benefits of a strong Spring quarter driven by lower gas prices and higher consumer spending.

- Acquisition by Pilgrim’s Pride Corporation. The rationale behind this deal is that it will enable #2 PPC to go head-to-head with #1 Tyson foods if PPC decides to acquire #3 SAFM. However, Tyson has exhibited its commitment to diversifying its product line by acquiring Hillshire last August for $7bn. This shields Tyson from swings in commodity prices. PPC too bid for Hilshire, but ultimately lost to Tyson. With $570mm free cash flow and no debt (implying an ability to take on more debt); PPC is ripe for acquisition plays. I’m not too confident that PPC will be eager to further its investments in the chicken industry, however. Instead, AdvancePierre Foods, owned by Oaktree Capital management, may seem like a likely play for PPC. AdvancePierre is a maker of burgers and foodstuffs. At a similar valuation to that of SAFM, a SAFM acquisiton seems unlikely

- Announcement of share buybacks and increased dividends. With a strong cash position and investments unlikely for the next several years (it has been rumored that SAFM is doing due diligence on production facilities in North Carolina), the time is ripe for SAFM to increase market enthusiasm by returning money to shareholders

- Lift on trade restrictions with China and Russia

At the present, I’m bullish on SAFM in the short term due to higher levels of consumer spending coupled with low commodity prices that should continue through the end of 2015. Given the price depression as a result of the Avian Bird Flu, I believe that SAFM can gravitate to 4.0x – 4.2x EV / EBITDA from its current 3.5x levels once the news blows over. If the equity begins to rally, this will give it a good lift coming in to Q2 earnings, which i feel will be boosted due to high levels of consumer spending and increased chicken consumption in the face of higher beef prices resulting from the California drought. I’m hesitant on SAFM as a longer term hold due to cyclical nature of the business and dependency on corn and soybean prices to deliver strong earnings. I will continue to track the equity in the next few days and may take a moderate position at $78.