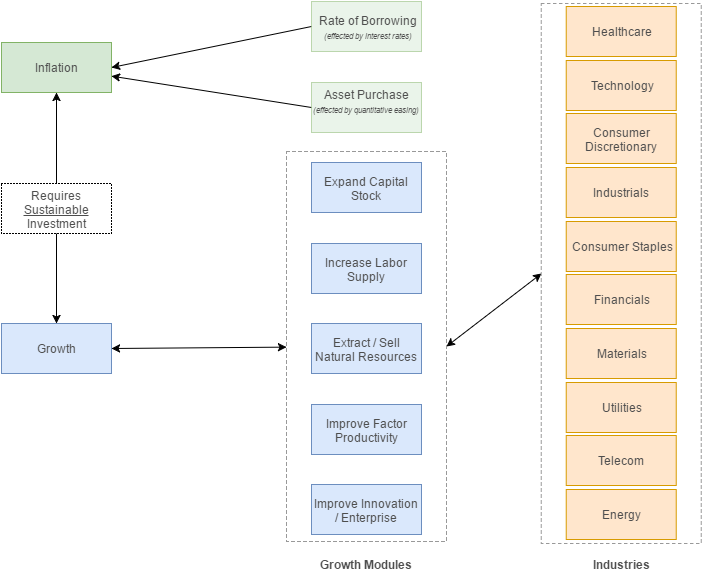

Macroeconomic Model for Growth

Simple Diagram which outlines the relationship between growth and inflation.

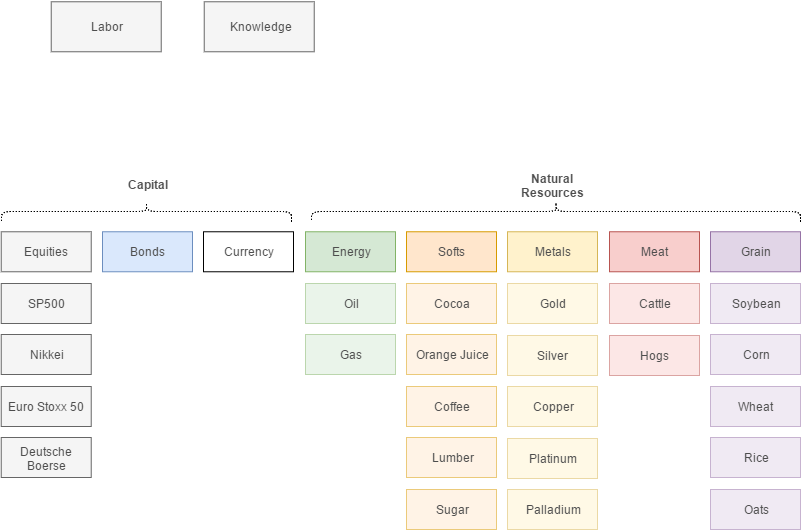

Risk Return Profiles for Various Asset Classes

Once we develop an understanding for trends in macroeconomic environments, we can begin to select which asset classes to diversify in to. In general, investors should be compensated marginal returns for marginal risk assumed.

[pdf-embedder url=”/xls/Theorems/Risk%20Return%20Profiles.pdf”]

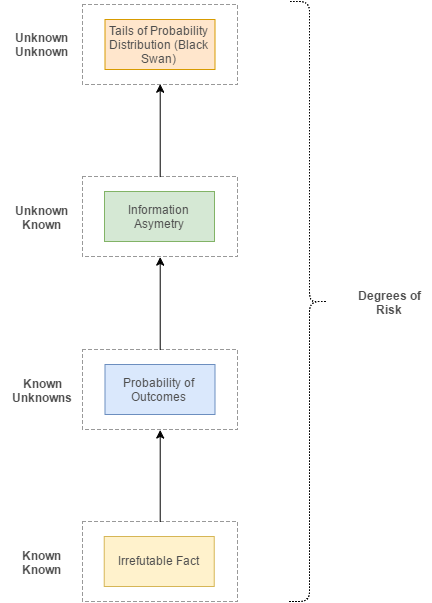

Assessing Risk

Risk compensation is determined by our degrees of understanding with an important emphasis on truth versus belief. The more we cannot assess, the higher degree of risk we take on (and theoretically, higher degrees of return). As such, contemplate the returns of the following asset classes:

- US Treasuries: guaranteed return (based on ability of the US to raise interest rates)

- SP500 Stocks: returns affected by industry competition and ability to execute

- High Yield Bonds: returns predicated on cash flows aligning with liabilities

- Leveraged Buyouts: can the business be turned around?

- Venture Capital: can the company capture market opportunity?

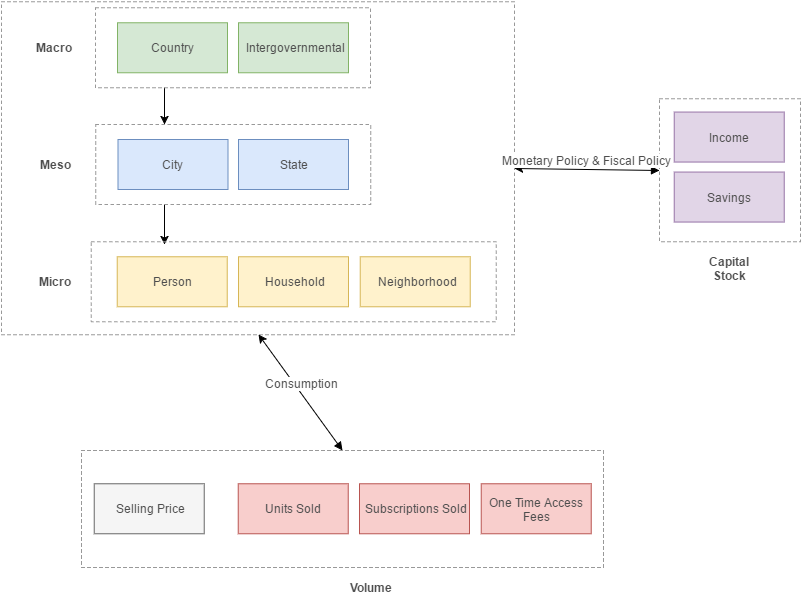

Assessing Market Opportunity

Resource Market