[iframe src=”http://kfguiang.co/d3/Consumer%20Discretionary/Equity/Advance%20Auto%20Parts/Operating%20Metrics/index.html” width=”100%” height=”550″]

Follow Up

- How AAP makes money

- Components of COGS (Sankey)

- Components of SGA (Sankey)

[iframe src=”http://kfguiang.co/d3/Consumer%20Discretionary/Equity/Advance%20Auto%20Parts/Operating%20Metrics/index.html” width=”100%” height=”550″]

Follow Up

[iframe src=”http://kfguiang.co/d3/Consumer%20Discretionary/Equity/Advance%20Auto%20Parts/Nodes/index.html” width=”100%” height=”510″]

[iframe src=”http://www.kfguiang.co/d3/Consumer%20Discretionary/Equity/Advance%20Auto%20Parts/” width=”100%” height=”550″]

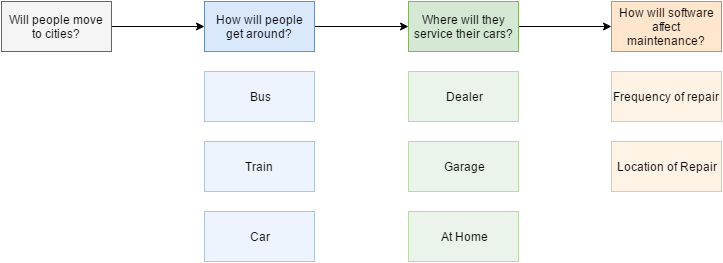

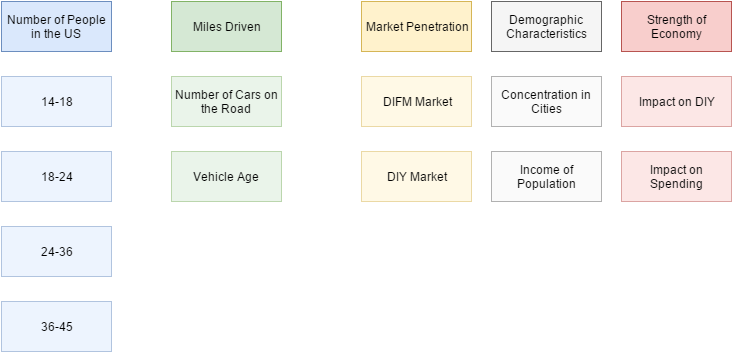

Macro drivers affecting the future of car repairs

Think: people need to get around. Usage of cars (potentially) continues to increase in popularity (also need to think about transportation in cities versus rural areas and subsequently, growth in populations…potentially, income too).

Key Points of Interest

In observing Advance’s ability to execute, I’m curious of the following:

Status Quo

[pdf-embedder url=”/ppt/Equity/AAP/AAP%20-%20Preliminary%20Investment%20Considerations%20(07.31.16).pdf”]

Overview

Other Notes