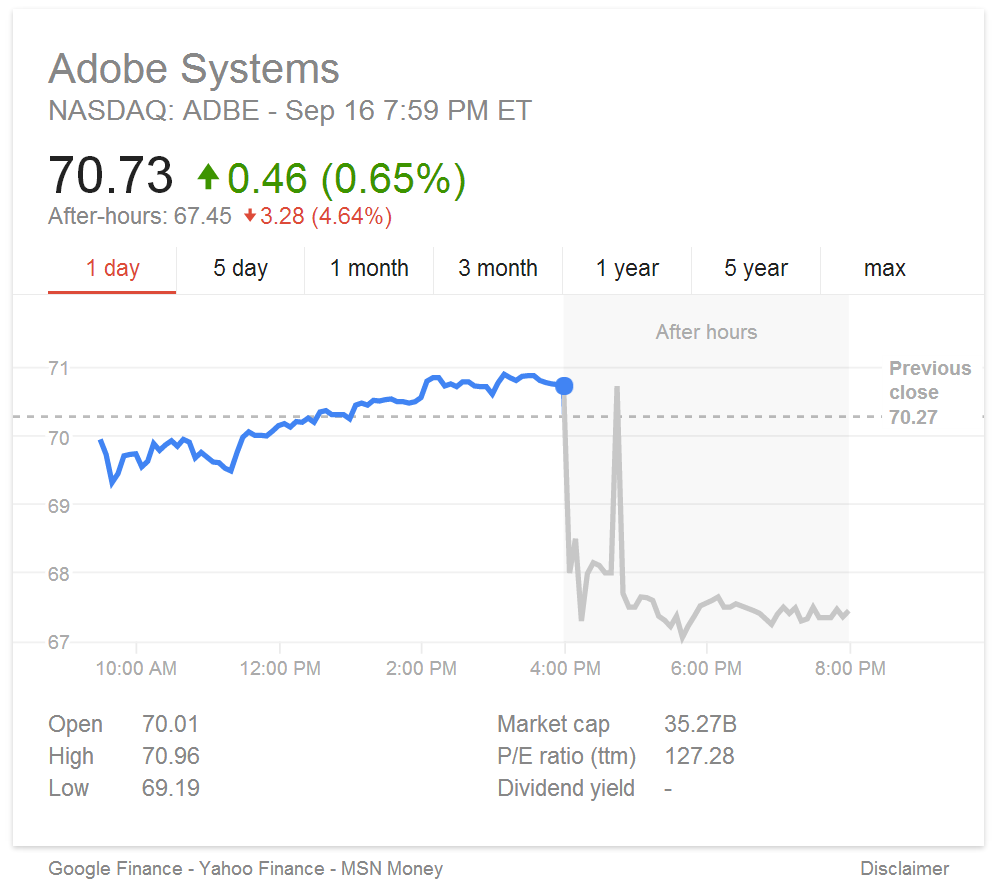

In her thought piece on Internet Trends in 2015, Mary Meeker of KPCB noted that Government / Regulation / Policy Thinking was the sector of society least impacted by the internet to date. The next two frontiers, according to Meeker, include Healthcare and Education. The most recent intersection between Government and Technology includes the deployment of Healthcare.gov in November 2013. Its impact was telling: on the day of its launch, the website received such a high degree of traffic that only 1% of people were able to enroll on the site during the first week of its operations [2].

Todd Park, the U.S. chief technology officer, initially said on October 6 that the glitches were caused by unexpected high volume when the site drew 250,000 simultaneous users instead of the 50,000-60,000 expected. He claimed that the site would have worked with fewer simultaneous users. More than 8.1 million people visited the site from October 1 to 4 [3]. White House officials subsequently conceded that it was not just an issue of volume, but involved software and systems design issues

One lesson of the fall and rise of HealthCare.gov has to be that the practice of awarding high-tech, high-stakes contracts to companies whose primary skill seems to be getting those contracts rather than delivering on them has to change. ‘It was only when they were desperate that they turned to us,’ says Dickerson [4]. ‘I have no history in government contracting and no future in it … I don’t wear a suit and tie … They have no use for someone who looks and dresses like me. Maybe this will be a lesson for them. Maybe that will change.’ [5]

The main problem associated with the Healthcare.gov launch is that policy makers and officials were preoccupied with whether people would be interested in accessing the site, instead of scaling the site to handle large volumes of traffic. Washington contractors spent $300mm building a site that didn’t work, only to be repaired by the best programmers of the private sector hailing from the likes of Google, Twitter, Facebook, and eBay in a tenth as much time [6].

Attempts at innovation in Education have become apparent, but not widespread. Kahn Academy, CodeAcademy, and Udemy are examples of web-based learning accessible to most with an internet connection. These tools, however, lack the interaction associated with in-classroom learning. While resources such as StackOverflow, Reddit, and Wall Street Oasis facilitate collaborative reinforcement by providing online forums for users to collaborate with one another, these online communities lack the direct connection of a mentee-mentor relationship. These relationships privilege a pupil when the most difficult part of learning a new subject or group of ideas is asking the correct question in the first place: this is where forums fall short.

In healthcare, companies like athenahealth and Castlight Health have made significant strides in standardizing medical information by easing the means by which by which information is collected and shared amongst doctors and patients. A primary challenge associated with this mission is dealing with cumbersome insurance companies and hospital infrastructure – many of whom lack the technological prowess or incentive to update their infrastructure to better serve patients. Perhaps the most widespread innovation associated with Government by way of technology is the implementation of Intuit’s TurboTax to file IRS Tax returns. It is an intuitive and pleasant experience, an improvement of pen and paper information gathering of the past.

It will be challenging to improve government infrastructure as these institutions provide jobs to many Americans. The Federal Government employs 4.2mm Americans, while States employ a cumulative sum of 3.7mm Americans [7,8]. Technological innovation can and will lead to many jobs lost; perhaps the greatest friction associated with implementing these changes is reallocating human capital to other sectors of the economy. However, it is in the best interest of society to incorporate the best of the private sector – real businesses that have experience deploying usable products – to improve an outdated and inefficient form of governance and governance services.

WeChat and the State of New York have made strides in digitizing and updating government processes as well as communications. WeChat grants citizens with access to appointment for entry-exit documents processing, marriage registration, accessing traffic violation records, driving license points, checking money in transport cards, public accumulation funds, endowment insurance, medical insurance, and real time traffic conditions [9]. The State of New York has made an effort to increase government transparency by providing its citizens access to data on economic development, education, energy & environment, government & finance, health, human services, public safety, recreation, transparency, transportation, and budget.

D.C. traditionally conflates the importance of a task with its cost. millions of dollars [were set aside] to build a website because it was a big, important website. But compare that to Twitter, which took three rounds of funding before it got to about the same number of users as Healthcare.gov—8 million to 10 million users. In those three rounds of funding, the whole thing added up to about $60 million [11].

In the age of the internet, it is nonsensical to bear and even perpetuate ineffective modes of data gathering, sharing, and accessibility. Pen and paper forms and mail submissions will soon be vestiges of the past. Waiting in line at the DMV and the sinking feeling associated with discovering that an Amazon Prime package will be delivered via USPS v. UPS or FedEx will (hopefully) be overcome. This frontier represents a significant addressable market opportunity: we can overcome the primitive quibbling in capitol hill and other state legislative chambers and incentivize the most qualified to update our outdated processes will we materialize.

The West Coast mentality could be counterproductive. “There’s an attitude in the entrepreneurial private sector where we don’t care what came before us: We’re going to disrupt it,” Dickerson explains. “But we are not going to disrupt Social Security. That’s a big reason why it’s so hard to make these changes, because you can’t interrupt the flow of operations [11].

Recently, the Obama administration has initiated a program to hire 500 tech employees by the end of 2016 to address infrastructural issues ranging from the IRS to Immigration Services [11]. 140 workers have been hired so far, and various services have already been improved, ranging from increasing access to federal student loan information on the Department of Education Website to increasing the accessibility associated with updating and completing I-90 forms – a historically arduous process that took months to process in the context of the common pen and paper convention – on the Immigration and Naturalization Services website.

Our leaders have recognized that many modes of operational efficiency adopted in the private sector can too be applied to the public sector . This is a relatively new phenomena: only recently have companies like Google, Facebook, and Twitter scaled to degrees sophisticated enough to handle millions of simultaneous users. As demonstrated in the Healthcare.gov fiasco, our government had previously adopted limited expectations associated with the popularity of their programs: only now do they realize that hundreds of thousands – even millions of users – will eagerly access these services if they are provided. Greenfield opportunities exist from a multitude of service organizations: logistics (USPS) can adopt similar tracking and databasing methods similar to those of FedEx, UPS, and Amazon. Information gathering and handling can be streamlined through digital processes which will alleviate brick and mortar infrastructures at the DMV and INS (Immigration and Naturalization Services). The IRS has already made significant strides with its implementation of Intuit’s TurboTax to aid Americans in filing their annual tax returns.

When we streamline these services, we’ll have a greater multitude of benchmarks by which to hold our policy makers accountable. When we digitize access to student loan information or immigration documents, we enable a much more efficient form of Democracy: policy initiatives and improvements can be easily tracked when understood on an engagement basis. We won’t only have information associated with how many users were interested in a prospective service (views on a website) but also understand whether the information was clearly conveyed, leading to higher levels of conversion (counting the number of people who don’t only access a site, but complete all forms, and submit aforementioned forms). These roll-outs, conducted on a macro basis (defined by the total addressable American population with access to the internet) – have the capacity to improve our governments connection to the society it governs. Idea generation is not enough in the age of the internet: implementation and execution are key.

[1] Mary Meeker (27 May 2015). “Internet Trends 2015”

[2] Paul Ford (16 October 2013). “The Obamacare Website Didn’t Have to Fail. How to Do Better Next Time”

[3] Tim Mullaney (6 October 2013). “Obama adviser: Demand overwhelmed HealthCare.gov”. USA Today

[4] Mikey Dickerson had taken a leave from Google in 2012 to help scale the Obama-campaign website and create its Election Day turnout-reporting software. He was subsequently recruited by Todd Park, US Chief Technology Officer to resuscitate Healthcare.gov

[5] Steven Brill (10 March 2014). “Obama’s Trauma Team”

[6] Todd Park, US Chief Technology Officer recruited Gabriel Burt (Civis Analytics), Mikey Dickerson (Google), Paul Smith (DNC Tech Operations), Ryan Panchadsaram (Presidential Innovation Fellows), Mike Abbot (KPCB), Marty Abbott (eBay), and Jini Kim (Google), among several others to resuscitate healthcare.gov in October 2013. The project took 7 weeks.

[7] Historical Federal Worforce Tables: Total Government Employment Since 1962.

[8] US Census, 2013: Annual Survey of Public Employment and Payroll

[9] Shanghai Daily: Government WeChat Services

[10] Data.NY.Gov: Data Access

[11] John Gertner, “Inside Obama’s Stealth Startup”