Comparative Analysis: Select Emerging Market Exchange Traded Funds in Argentina, Russia, India, Mexico, Brazil, and Indonesia

For as long as I can remember, I’ve been fascinated with the concept of emegring markets in the developing world for two primary reasons. The first is that innovation in these countries generally necessitates low-cost solutions. Second, I’m encouraged by the concept of the second mover advantage. The first mover stomachs the cost of innovation while the second mover plays the game of catch up. This is what we’ve seen by way of China and India. By way of innovation in an absolute sense; these countries may not be at the forefront, but at least a goal is achieved, which exists by way of improved standards of living in these countries.

Over the course of the next few months, I am looking to track markets in Indonesia, Argentina, and India. Russia and Mexico will be at the tertiary nodes of my observations.

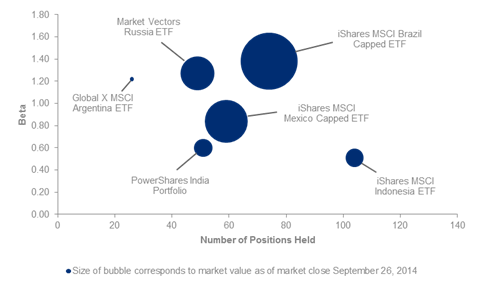

This evening, I’ve chosen to highlight several factors to begin my analysis. I chose to underscore market volatility (by observing ETF beta), alongside the # of positions held in various equities, relative to the market value of all positions held.

- Market volatility: beta is used to represent an index/equity’s correlation with the broader market. Within our sample set, we look at the average beta of all positions held by an ETF relative to a regional specific benchmark. Values below 1 imply that on average, equities within an index will suffer less from volatility in the market relative to the aggregate benchmark. 1 implies perfect correlation. Values exceeding 1 imply that the equities generally are susceptible to exaggerated swings relative to general market movements. Not surprisingly, the Latin American equities observed here are relatively volatile equities. This is a common trend amongst countries in the emerging market – capital from opportunistic investors flies in from abroad when times are good; and just as easily as the capital flies in, it just as quickly flies out. I believe that the low levels of volatility in India and Indonesia derive from lack of investor appetite in those markets, primarily because foreign investors are not very acclimated with delving in to the region on a general basis.

- Number of positions held: I selected this metric primarily because it is an indicator of regional diversity across different industries. The fewer positions held by a given ETF implies that a country is susceptible to a concentrated few companies, which represents significant risk (if a Company performs poorly, for a variety of reasons, it is possible for the Country as a whole to suffer as well). In future iterations of my analysis, i look to sophisticate my analysis by including information that breaks down holdings on a sector specific basis, alongside expected returns within those industries. I am particularly eager to observe Argentina’s energy & industrials boom, given recent positive developments and discovery of resources in the region.

- Market value: perhaps is the most obvious point of analysis. It makes sense that Brazil is exponentially larger than its peers. I chose to include this to highlight that emerging economies cannot be basket. Some markets are more sophisticated than others.

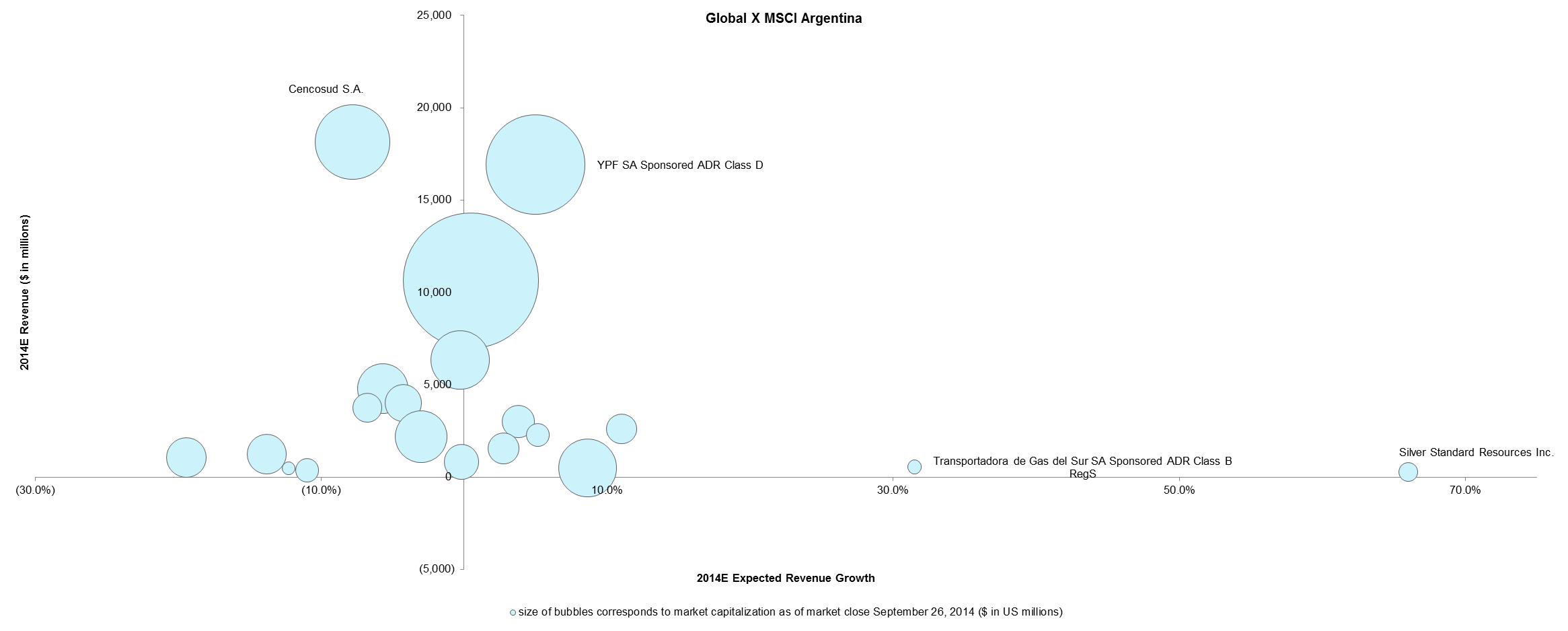

I’ve included a draft, for purpose of my personal notes below. Within each ETF, I will look to compare revenue growth relative to recorded revenue values of different companies, also highlighting market sizing.

Draft ETF analysis: Argentina